tax identity theft occur

That could change this year for thousands of taxpayers who were victims of identity theft and receive an unexpected 1099 form from a state that paid unemployment. Ad Answer Simple Questions About Your Life And We Do The Rest.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent.

. Nows the Time to Get Powerful Score Planning Report Protection. Taxpayers should be alert to possible tax-related identity theft if they are contacted by the IRS or their tax preparer about. The IRS recommends you take the following steps if you feel one of the above has occurred that may have resulted in your identity being compromised.

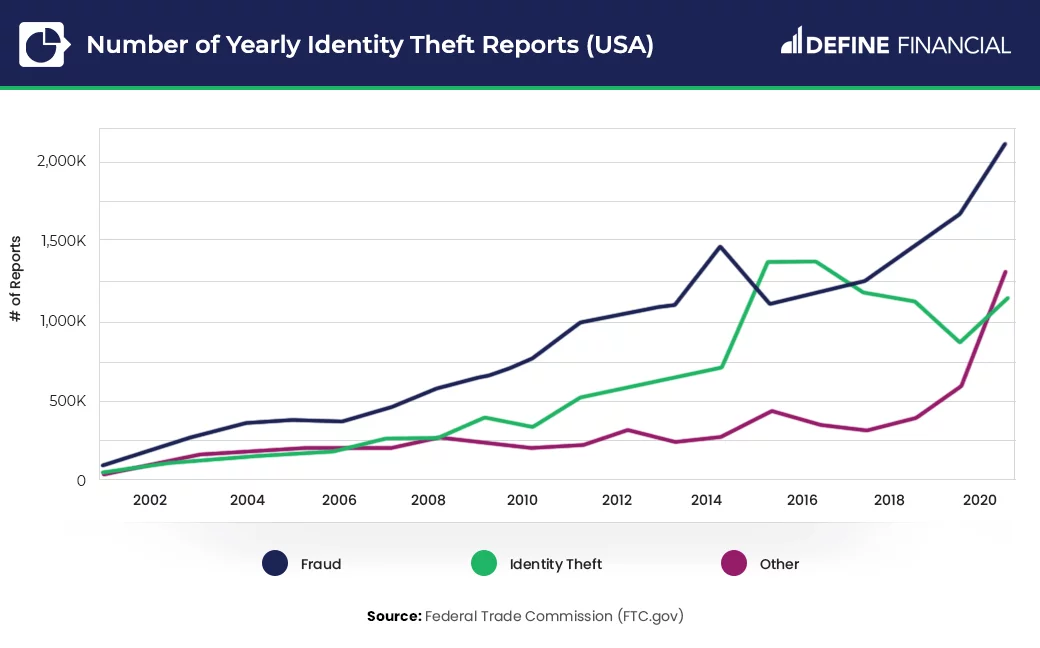

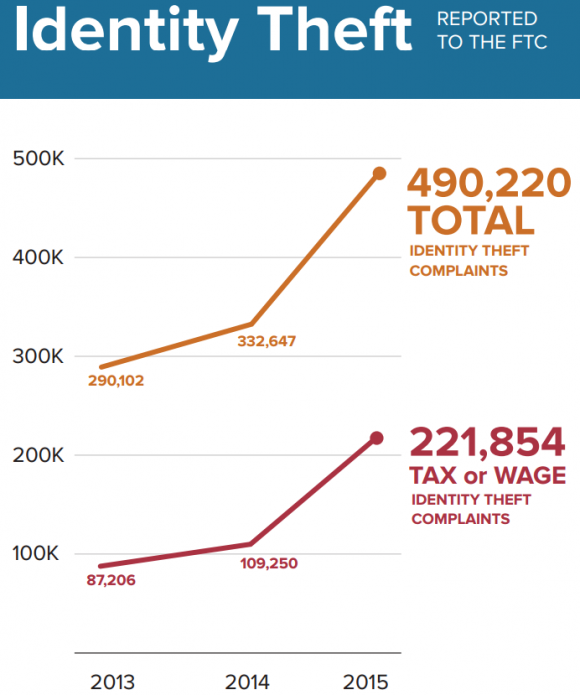

When the real taxpayers file. Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. Out of 3 million reports last year 15 are related to identity theft.

In this increasingly common scam thieves use victims personal information to file fraudulent tax returns electronically and claim bogus refunds. Refresh Your Credit Daily with TransUnion. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that.

Tax identity theft happens when someone files a phony tax return using your personal information - like your Social Security number - to get a tax refund from the IRS. Ad Change Happens Fast. Ad Find the Best Ways to Avoid Identity Theft in 2022 Take Control of Your Credit Activity.

Dont Be That One. Ad Change Happens Fast. More than one tax return being filed using the.

Ad Guard Against Breaches of Lost or Stolen Credentials with Password Protection. Join a Plan Today Starting 899. Identity theft may be.

Identity theft occurs when someone obtains your personal or financial information and uses it fraudulently without your permission. Personal tax ID theft happens when someone has stolen your personal information in order to file a fraudulent return. From Simple To Complex Taxes Filing With TurboTax Is Easy.

People often discover tax identity theft. Understanding Where Tax Identity Theft Occurs. Place a fraud alert on your credit file with one of the three major credit bureaus.

This happens if someone uses your Social Security number. What Is Tax Identity Theft. Identity Theft happens to 1 Out of 4.

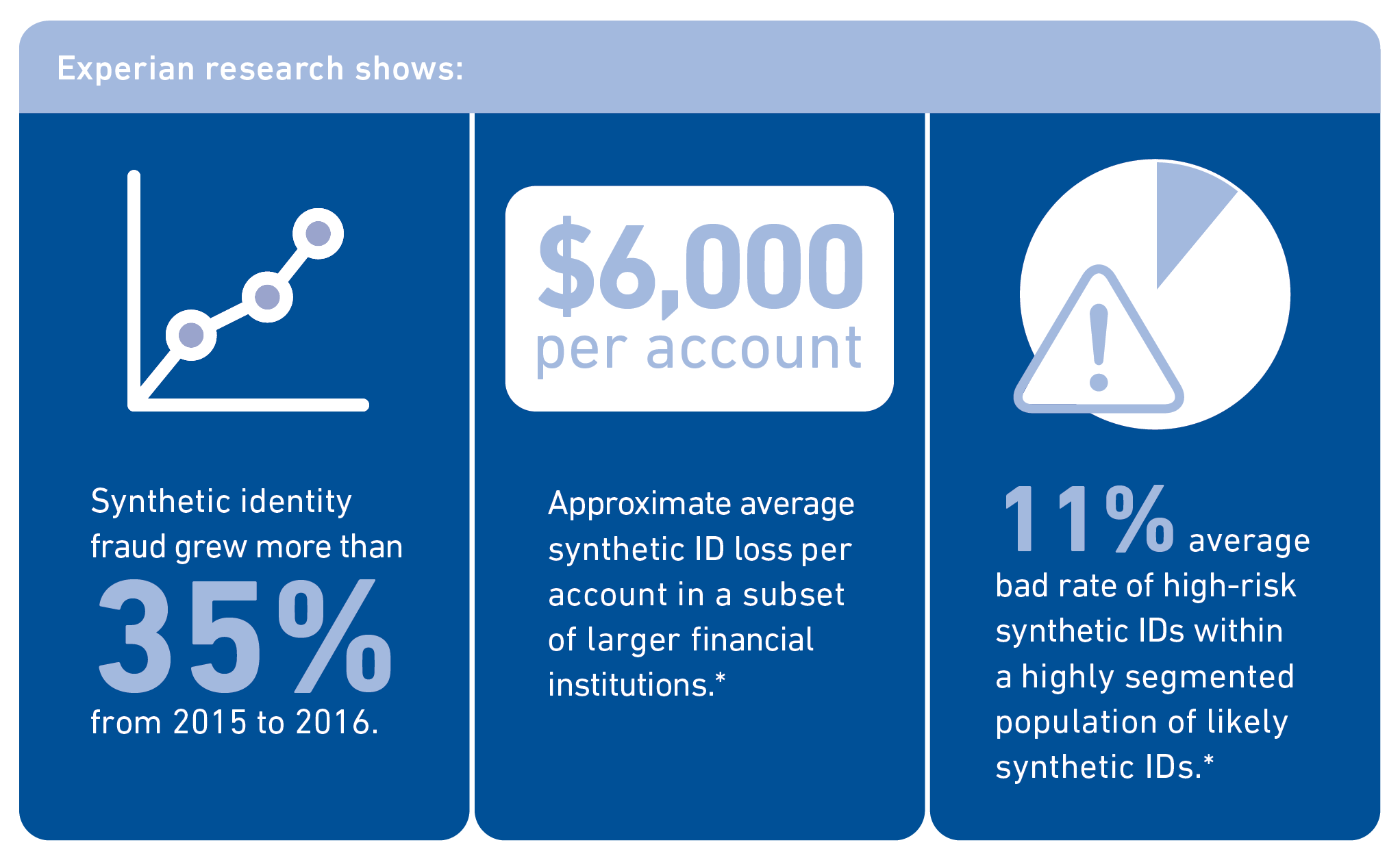

File With Confidence Today. Credit Scores Can Change Daily. Tax identity theft fraud is different from other identity theft not only because it targets your tax returns but also because.

Refresh Your Credit Daily with TransUnion. Improve Visibility and Control Access with Adaptive Policies Based on Contextual Factors. If you suspect you are a victim of tax identity theft here are some steps to follow.

According to the Federal Trade Commission in 2019 Georgia has the highest percentage of identity theft. Credit Scores Can Change Daily. Nows the Time to Get Powerful Score Planning Report Protection.

Tax identity theft is when someone uses your Social Security number to steal your tax refund or for work.

Tax Identity Theft American Family Insurance

What Is Identity Theft Definition From Searchsecurity

Tax Identity Theft What To Do If You Ve Been Targeted

Irs Tax Refund Identity Theft How It Can Happen To You Irs Taxes Tax Refund Identity Theft

![]()

Business Identity Theft National Cybersecurity Society

The How And Why Of Tax Identity Theft Itrc

Ftc Tax Fraud Behind 47 Spike In Id Theft Krebs On Security

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Identity Theft Statistics Experian

Ftc Tax Fraud Behind 47 Spike In Id Theft Krebs On Security

True Or False How Much Do You Really Know About Identity Theft Victim Support Services

Tax Identity Theft American Family Insurance

True Or False How Much Do You Really Know About Identity Theft Victim Support Services